Since September 27, 2020, legal entities and partnerships established on or after this date in the Netherlands must report their Ultimate Beneficial Owner(s) (UBO) immediately upon registration at the Dutch trade register. For existing entities, the UBO registration could be deferred by 18 months, which means the deadline for the UBO registration of existing entities is now nearing fast.

All legal entities must register the natural person(s) who qualify as UBO or Pseudo-UBO ultimately on March 26, 2022. Failing to comply with this on time is an economic offense. For the avoidance of doubt, the abovementioned does not apply to trusts and similar legal structures in the Netherlands. The implementation of the legislative proposal with regard to the UBO registration for trusts and similar legal structures is currently still in process.

UBO

In short, all natural persons must be registered who have control over the entity by:

(i) (in)directly holding more than 25% of the interest as shareholder, holder of voting

rights or holder of economic interest; or

(ii) having effective control.

Pseudo UBO

If no formal UBO can be appointed, then the total statutory board of the Dutch entity that is subject to the UBO registration must be registered as pseudo UBO. In addition, in the event a legal person is the statutory director of the Dutch entity, any natural person who is a statutory director of the legal person-director must be registered as the pseudo UBO of the Dutch entity.

Exemption for listed companies

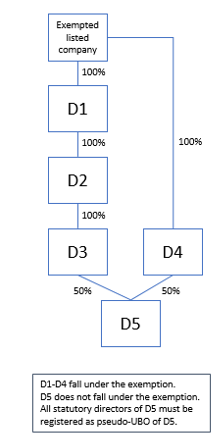

Listed (European) private or public limited liability companies that are subject to disclosure requirements consistent with Directive 2013/50/EU or subject to equivalent international standards which ensure adequate transparency of ownership information (such as UK, US, Singapore, Canada and Australia) are exempted from the obligation to register their UBO(s). The exemption also applies to all legal entities that have a 100% relationship with an exempted listed company.

According to the note on the report on the bill (Dutch Senate, session year 2019-2020, 35 179, C p.4), this exemption does no longer apply if the company structure is organized in such way that there is not a 100% (in)direct relationship with the exempted listed company (for example because it has two shareholders) even if it forms part of the same structure (see ’D5’ in the below example).

Example exempted listed company / pseudo UBO for a not 100% subsidiary

Although the situation above was most likely not been provided for at the time the exemptions where defined, it is advisable to do a UBO registration for D5 after all in order to avoid being accused of an economic offense.

If you need any help with the registration of the (pseudo)UBO(s) at the Dutch trade register or the determination of the UBO within your organization, we are happy to assist. In case you have any questions in relation with the UBO register or require assistance, please do not hesitate to contact us.